San Francisco at Center of Globalization

Historical Essay

by Richard Walker, 1996

Originally written for the journal "Urban Geography" in 1996.

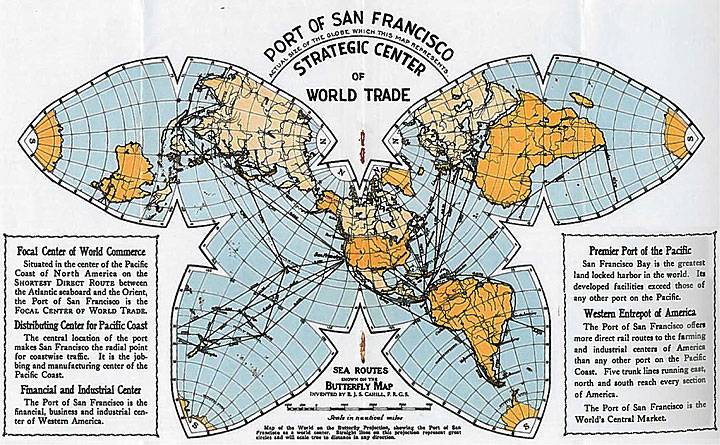

Strategic Center of World Trade, as seen in 1923.

Image: San Francisco Chamber of Commerce

The current obsession with globalization runs the risk of erasing geography, setting back the clock to the days of featureless plains in location theory. In seizing upon fashion, we ought not lose sight of the dialectics of the local and the global and of the importance of place. Local studies still have much to teach us. (1) Recognition of significant ways in which globalization has increased in the late 20th century does not leave us any nearer the answer to the four great and enduring puzzles of the study of capitalism, development and world systems. In the following ‘Cook’s tour’ of San Francisco’s dealings with the world economy, we shall find some old conundrums reappearing in the guise of one city’s historical geography. (2)

The first puzzle is historical comparison. On what basis do we say that recent years have been more global than the distant past? California has been part of the European world system since the 18th century, and at no time since has it been anything like an entity unto itself. Swept up in the throes of Spanish colonialism, Yankee conquest or war in the Pacific, it has undergone repeated transformations of its external relations and internal economy. No doubt the intensity of global economic reach has deepened in significant ways, but it has also slackened at times and previously dominant activities have dropped away altogether, as with silver or the wheat trade. One cannot trace a simple rising line of globalization from regional to national to international economic integration. Thus, despite a century of debate over national integration, imperialism and world systems, the way California (or any other place) fits into capitalism’s global march remains an open question. Better to speak of “another round” of globalization. (3)

The second puzzle is how to disaggregate and differentiate the notion of global economy into its constituent parts. Here we can call on industrial and urban geographers’ ideas of linkages, city systems, and networks. External trade is the barest measure, to which one must append financial (capital) flows, migration (labor) flows, and production linkages (complex divisions of labor). To this should be added ties of ownership, corporate organization, cooperative relations, and competition. Then, too, one must account for technological connections and contributions, as when California exported not only gold but mining engineers around the world. (4) Today, San Francisco hangs suspended from a global web made up of European food and computer markets, British and Japanese investors, Asian and Latin immigrants, Arabian and Venezuelan oil wells, and universalized technologies in nuclear power, microchips, and concrete dams. Teasing out the various strands of globalization is a daunting task, and this essay can only be suggestive of the complexities of the term globalization.

Puzzle number three is growth and dependency, or simply what makes it possible for a place to develop within a global economy. Does growth rest on agriculture or industry, export or the home market, local firms or branch plants? Is it necessary to innovate locally or to import technology, to attract foreign capital or mobilize local savings, to bring in skilled labor or learn by doing? The local economy may prosper from the opportunities created by global demand, foreign investors or rapidly-universalizing technologies or it may suffer from indebtedness, declining terms of trade, profit repatriation, and technical lag, among other things. California was a classic resource semi-periphery which turned gold and furs into capital, adventurers and plunderers into industrialists and laborers with a remarkable degree of creativity, and distance from the global centers of capitalism into room to maneuver. Behind this lies a big measure of freedom due to race, resources and federalism, that is, a white settler region with access to abundant land and natural wealth, with an imperial and redistributional state at its back. California comes into modern history shining with promise and dripping with blood. Global opportunities and challenges are thus necessary but insufficient to explain growth and decline; internal social relations and production conditions are the crucibles of growth. (5)

The fourth and last puzzle is how localities swept up by capitalist expansion may alter the whole, rather than falling victim to global processes. The prevailing view in most theories of world systems, city systems, imperialism and national integration is that expansion into new territory merely adds modal units to the larger geographic realm without shaking up the established hierarchy of places and powers, and usually without injecting anything particularly new into the system. Tokyo becomes a “global city” but this does not alter or destabilize the global market in any major way. (6) Even those geographers attuned to the geographic fabric of “nodes and networks” and the necessary implantation of the global in definite places depict this in terms of globalization taking root in the local rather than local seeds sending out shoots into the global economy, much less taking it over root and branch. (7) The latter is, to borrow a phrase from Marx, the truly revolutionary path of global-local dialectics. As we’ll see, it is illustrated several times over in the history of California, from quicksilver to micro-circuitry. (8)

The Golden Globe

Alta California entered the European world system as a far outpost of the Spanish empire. Spain moved its colonial apparatus northward in the late 18th century to secure its claims against the advancing fur-traders of Russia and Britain — with whom they began trading. Trade quickened with the Mexican revolution of 1821, which transferred mission lands to a class of cattle ranchers selling hides and tallow. British, American and other adventurers trickled in with the rivulets of commerce (often via Latin America), marrying Mexicans, setting up trading posts, and shipping out beaver pelts. (9) Hudson’s Bay Company set up office in San Francisco, and Boston merchants made it a regular port of call. Quicksilver was soon added to Californi’s exports, after the discovery of New Almaden mine near San Jose. ‘Sleepy’ Alta California was awake long before the arrival of the 49ers.

California next became a prime target of US expansion, as this upstart naton-state consolidated its grip on the North American continent. Mexico was invaded in 1846 and forced to cede one-third of its territory to the blond beasts of the north. Sabre-rattling President Polk started the war in order to annex Texas, gain access to Pacific ports at San Francisco and San Diego, and seize the mineral riches of California (Barrera 1979). NAFTA has a long pedigree.

With the Gold Rush of 1848-55, California leapt into the global spotlight, exciting economic activity, political maneuver, and personal ambition from Europe to Asia. Miners poured in from all corners of the world, including Chinese, Chileans and Mexicans as well as Europeans, Yankees and Southerners, and San Francisco instantly joined the ranks of the top ten cities in the United States. Men rubbed shoulders in a rough kind of equality in the streambeds of the Mother Lode or at the gambling tables of San Francisco. California was, in a sense, the only successful revolution of 1848, a moment of liberation that freed tens of thousands of young men to pursue their fortune (Lotchin 1974; Barth 1975).

The Gold Rush was equally a moment of European conquest. White miners and militias killed off the remaining 50,000 indigenous Californians, while expropriating the property of the Mexican bourgeoisie (Forbes 1982; Pitt 1966). (10) The Mexicans, Chileans and Chinese who taught the Anglos how to placer mine were driven out of the goldfields by violence and a Foreign Miners’ Tax (Camarillo 1984). The centuries-old Anglo-Irish war was transplanted to San Francisco, where the first freely elected Irish government was overthrown by Anglo-Yankee merchants, making the word ‘vigilante’ notorious round the world (Senkawicz 1985).

Gold flowed in quantities not seen since the Spanish pillage of Mexico and the Andes — $128 million in the first five years, $1 billion in the first twenty. (11) The US economy, suffering from lack of specie for currency and bank reserves (coins of all nationalities were freely circulating before 1850), suddenly found the liquidity it had lacked (Studenski & Krooss 1963, p 124). (12) Exported to grease the wheels of US trade, California gold lubricated the wheels of Victorian world commerce for the rest of the century. Later, Nevada silver flooded the world, and was especially sought after in China and Japan (Willis 1937).

Quicksilver was California’s leading export after gold through the 50s, and had a dramatic effect on the world market for mercury and global production of precious metals through the end of the century . Exported in quantity to Mexico, Peru and China, California quicksilver made up well over half the world’s production from 1850 to 1880 and broke the Rothschild’s cartel (based on the two great mines of the previous 300 years, Almaden and Idria) (St.Clair 1994/95; Goldwater 1972). (13) The New Almaden mine was developed by a Mexican, owned by an Anglo-Mexican company from 1850-64, and then taken over by Boston capitalists.

As riverine gold ran out, mining went deep, requiring huge capital investments. This and the discovery of the Comstock Silver Lode in Nevada in 1859 changed the character of San Francisco dramatically, from a libertarian field of dreams to a gaming house for big capital (Decker 1978). Giant fortunes consolidated in the hands of the Silver Kings (who were, ironically, Irish), followed by the Central Pacific railroad’s Big Four and the Wheat Barons of the interior (Lewis 1947, 1951; Peterson 1991; Shinn 1901). San Francisco became a new pole of accumulation, its coffers filling rapidly with gold and silver (Hittell 1878; Cross 1929). (14) The Bank of California under Bill Ralston, the Bank of Nevada begun by the Silver Kings (partly to break the ‘Ralston ring’), and Wells Fargo Bank under Lloyd Tevis (partner of George Hearst) were all based on Comstock silver, while the fourth big bank was begun by Charles Crocker of the Big Four. In commercial banking, San Francisco and the west would remain the most independent region of the country into the next century (Willis 1937, p. 18). San Francisco’s mint turned out the West’s hard money supply up to 1933. (15)

The San Francisco Mining Exchange (originally the Stock and Exchange Board) was the second stock exchange in the United States (1862) and briefly surpassed New York’s exchange in the 1870s as the largest stock market in the world, and the most sweaty-palmed from speculative fevers (Carlson 1942; King 1908). Orders came from around the US and Europe. Like Chicago, San Francisco was able to outflank New York (though eastern exchanges soon followed suit) (cf. Cronon 1991). Ironically, the wide-open gambling houses closed by the vigilantes resurfaced as the ‘Change’, and San Francisco maintained its reputation as the biggest gambling center on the continent before the Comstock Lode petered out in the 1880s. Despite outside investment, most of the fortunes were won and lost in San Francisco itself (Carlson 1942; Hittell 1878). (16)

San Francisco became a regional sub-center in the 19th century global financial network centered in London (Reed 1981). (17) Although American banks were minor players in world commerce at this time, almost all foreign trade on the Pacific Coast was financed through San Francisco merchants and banks, which had correspondent relations in London, Paris, Berlin, Tokyo and Hong Kong. Only one local bank, Wells Fargo, had a foreign branch (in London), but several foreign banks from London, Paris, Montréal, Bombay, and Vancouver established branches in the 1860s. The Rothschilds were represented by B. Davidson & Co. (from 1849), and were allied with Anglo-California Bank. Chinese and Japanese banks including Sumitomo and Bank of Canton (still major California players) entered at the turn of the century. San Francisco had an independent currency market (in sterling, yen, HK dollars, rupees, etc.) of limited scope for foreign transactions (Willis 1937; Doti & Schweikart 1991).

Throughout the century, English and Scots’ capital flowed into the United States, and was prominent in the development of California and the American West (Hobson 1914, Jenks 1938, Jackson 1968). They established agencies, such as Balfour, Guthrie & Co (branch of Balfour, Williamson of London) and invested in every type of enterprise: mining, forestry, oranges, drainage, railroads and mortgages. Bursts of speculative interest hit in the 1850s, 70s and 90s; almost one-half of the mining shares sold in London in the frenzy of 1870-73, for example, were for companies in the American west, the majority in California and Nevada. While some of the best mines were British-owned, like Sierra Buttes for gold and Iron Mountain for copper, millions of pounds were lost in speculative ventures (Jackson 1968). (18)

Queen City of the West

In the third quarter of 19th century, San Francisco’s gaggle of nouveaux riches were kings of all they surveyed, reigning over an extractive empire stretching to Alaska, Mexico and Hawaii. With 150,000 people by 1870 and 350,000 by the end of the century, the city held about one-fifth of the populace of the entire West Coast and climbed to seventh largest city in the country (including Oakland). San Francisco used its mercantile network, transportation system and financial clout to bring the western US under its hegemony (Pomeroy 1965; Issel & Cherny 1986) and Nevada was reduced to peonage, a gigantic rotten borough run out of Palace Hotel bar (Ostrander 1966). Prospectors fanned out across the west and north to Alaska, followed by big investors such as George Hearst, who used his Comstock fortune to buy into Dakota gold, Mexican silver and Montana copper. Merchants sent agents and established branches from Seattle to Phoenix, while San Francisco became the financial hub of the west, with an overwhelming concentration of depository and correspondance banks, insurance and underwriting companies, stock exchanges and brokerage houses (Willis 1937, p 51; Issel & Cherny 1986). The Central (Southern) Pacific “Octopus” spread its tentacles throughout California and the Southwest. The city’s rapacious Alaska Commercial Company and Alaska Packing Association cleansed the eastern Pacific of whales, fur seals, otters and salmon. Meanwhile, forests up and down California were stripped for mines and saw timber. (19)

Hawaii was the lynchpin of San Francisco’s empire in the Pacific, and its conversion to sugar plantations coincided with the rise of California. The sugar kings of San Francisco, led by Claus Spreckels, Castle and Cooke and California and Hawaii, held the islands under their thrall by the 1880s (Adler 1966). Hawaiian sugar sweetened the taste for power, as well as preserve canned fruit. Great steamship companies grew up to ply the route between the Islands and the Coast — Dollar, Oceanic (Spreckels) and Matson (a Spreckels spinoff); they joined Pacific Mail (Southern Pacific), Occidental and Oriental, and Pacific Coast Steamship in controlling the northern Pacific. The US dominated trade with Japan and northern China, and even coal was imported to California from China before 1900.

As California pushed the mining frontier outward across the American west, the state’s own mining fortunes declined; the last great western gold and silver strikes were in southern Nevada at the turn of the century. (20) But how does one measure the impact of technology and expertise? California mining technology fanned out across the globe (Vance 1964). Mining equipment such as drills, nozzles and pumps built by Risdon, Aetna and Union Iron Works and other machine shops was shipped around the world. Explosives fabricated by Cal Cap, Giant, Nitro, and Hercules Powder works in the East Bay were used at mines from Alaska to Spain. The Washoe mercury process was the main gold and silver extraction method from the 1860s to the 90s. Mining engineers such as John Hays Hammond and Herbert Hoover became major international consultants (Hammond 1935). After a brief period advising British investors in the Western US, Hoover became the key mining engineer in the West Australian fields in the 1890s, worked in China, founded the (Rio Tinto-)Zinc Corporation, and went on to be the most prominent technical advisor and investor in London mining circles in the decade before World War I, when London was the global hub of mining capital (Nash 1983). (21) Hoover, who took many Stanford friends with him around the world, claimed that California engineers dominated the mining world (ibid, p. 486). (22)

As mining flamed out in the 1880s, the leading edge of the California economy became an immense agro-industrial complex. It took root in the 1860s when San Francisco merchants captured a share of the British wheat trade (Paul 1973). Wheat was grown in the warm interior valleys, which had been bought up by the city’s capitalists in ten-league chunks, creating the greatest bonanza farms of the era. (23) Because the wheat was particularly hard and dry, it kept well through the long voyage around the horn by clipper ship (and kept alive New England shipbuilding long after steam) . Wheat and flour made up about two-thirds of non-metallic exports during the 1870s and 80s (Willis 1937 p. 226). Wheat also supported a vigorous farm machinery sector of considerable ingenuity, e.g., the Mitchell Straw-Burning Thresher (1885), Victor Mowing Machine (1882) or Climax Side Hill Plow (c. 1875) (Hinkel & McCann 1939).

Another pioneer agribusiness operation was the team of German butcher, Henry Miller, and merchant Charles Lux who built a million-acre cattle operation to serve the San Francisco market (Igler 1996). Spreckels built the first sugar refinery in San Francisco in 1863 and Castle & Cooke, C&H and Alameda Sugar soon followed suit. Fruits and vegetables came on the scene later, after 1870, but passed up wheat as the state’s leading cash crops by 1890. Canneries and packinghouses sprang up all around the Bay Area and Central Valley, and Oakland’s J. Lusk & Co was purportedly the world’s largest cannery in the 90s. Such preparation made California produce saleable at long distance, making the Santa Clara Valley world famous for its prunes long before its silicon chips. The North Bay became America’s premier wine region, financed by San Franciscans and made by Italians (Hutchinson 1984). Merchants such as Gundlach & Co shipped to Britain and the California Wine Association (created by SF merchants after 1906) ran the biggest winery in the world until Prohibition shut it down. Leslie Salt works supplied all the table salt throughout the western US from bay drying beds. In 1900 food processing was the city’s largest employer (Issel &Cherny, p 55).

California’s economy rapidly diversified from the Civil War onward in both industry and agriculture. (24) Because San Francisco’s dominant role was mercantile and financial, a mistaken view arose that it was not an industrial city (25); yet by 1880, San Franciso manufacturing occupied a third of the workforce and produced more than all other western cities combined (Issel & Cherny 1986, p. 25). Similarly, because regional growth was grounded in natural resources, California industry was long dismissed as merely ‘extractive’ (e.g., Parsons 1949); yet agro-processing was the leading sector in the United States, so why should California be different? (cf. Page & Walker 1981). Because California was relatively isolated, the chief explanation for industrialization has been the local market (e.g., Issel & Cherny, p 24); yet San Francisco was the nation’s fourth biggest entrepot for foreign trade by 1890 (ibid). (26) Without question, San Francisco industry was force-fed with by locally accumulated capital (Trusk 1960), but the key factor, almost never mentioned in local histories, was skilled labor and innovation. The occupation structure was more skewed toward professions and craft skills than any other US city (Issel & Cherny, pp. 54-55). California’s open possibilities and influx of human talent meant that the same process of technical change set loose in mining infected almost every other enterprise — and does so to this day.

San Francisco and the Bay Area boasted an array of vigorous industries in the last quarter of the century. Local machine shops turned out tools and equipment for sawmills, sugar mills, printers and factories of every kind — and not only for the California market. Union Iron Works became a major shipbuilder, and many lumber schooners, ferries and fishing boats were built at the bay’s edge. Ships and merchants were supplied with barrels, boxes, cordage and sails. Carriages, buckboards and cablecars were assembled in San Francisco by Pioneer Carriage Works and many small workshops. The biggest oil exploration and refining company of the time, Pacific Coast Oil (organized by Charles Felton and Lloyd Tevis in 1878) built the state’s largest refinery (Taylor and Welty 1950); from there they exported kerosene and lubricants to China, Hawaii and Mexico. (27) Rolling mills were built by Pacific, Judson and others around the Bay, and foundries were commonplace.

Construction materials were supplied by local lumber yards, turning and planing mills, and paint companies, and cement plants followed later. Household goods such as furniture, pots and pans, and cleansers and soaps were made locally, as well. Pioneer Wollen mills in San Francisco wove miners’ blankets, California Cotton Mill in Oakland turned out cloth, Levi Straus dominated the western market for men's workclothes, and Kraker and Israel did the same for women’s and children’s clothes. Several tanneries fed leather to the makers of shoes, harnesses, drivebelts, etc. The rich had jewelers and silverplaters, and men their cigar makers. Businesses and wealthy families bought Hermann Safes and Schlage Locks. The most visible industry was perhaps printing and publishing, led by the mighty daily newspapers such as the Chronicle, Examiner, Call and Bulletin (Bruce 1948). Blake, Moffitt and Towne, Crown Willamette and Zellerbach dominated the west coast production and marketing of paper.

Agriculture and the railroads boosted the supply of cheap labor — scarce among whites — by importing thousands of workers from China, Japan, Korea, India, the Philippines and Mexico (Daniels 1982). No sooner had white miners brought 50,000 ‘Chinamen’ to heel in the 1850s than the Central Pacific recruited ten thousand more to build the transcontinental railroad. The concentration of wealth and capital after the Civil War, followed by the Depression of 1875-78, again struck fear into white workers about the depradations of ‘coolie’ labor; not surprisingly this was led by the Irish, the nearest substitutes at the bottom of the labor market, (28) and a frenzy of anti-Chinese racism led to the Chinese Exclusion Act of 1882. Despite this, Asians could not be kept out. Hawaii became a stepping stone for Asian migration to California, as the sugar barons recruited thousands of Japanese, Chinese, Korean and Filipino workers ‘contract’ workers (Chan 1991). And between the peaks of Asian immigration in the 1860s and 1900s, Europeans poured into San Francisco to partake of its high wages and burgeoning labor demand: Germans, Irish and Italians predominated, joining the English, Scots and Chinese. The city reached extraordinary proportions of foreign-born in the 1870s and 80s — at times exceeding 70% — highest in the United States (Issel & Cherny, p. 55; Wollenberg 1985).

Imperial Ambitions and Domestic Rivals

As the US rose to a position of global power at the turn of the century, San Franciscans swaggered along with Teddy Roosevelt and his manly burghers of the East Coast; they saw the city as the Gateway to the Pacific and the unlimited frontiers of East Asia (Brechin 1990; Kahn 1979). Yet those imperial ambitions were soon checked by global rivals and upheavals, and both California and the United States turned inward to concentrate on their own deepening powers of production and consumption. By the end of two ruinous World Wars, the US would emerge astride the globe, thanks to its unchallenged economic strength; the irony is that the march to global hegemony took such a nationalist route — much more so than Britain in the 19th century (Ingham 1995).

So successful was enterprise on Hawaii (annexed in 1899), Spreckels and fellow planters coveted the Philippines, ripe fruit among the dead branches of Spanish colonialism. William Randolph Hearst — who turned his father’s fortune into a newspaper empire beginning with the Examiner — helped trump up a “splendid little war” with Spain in 1898. Several warships that turned Manila to flame were built by Union Iron Works. Californians’ intimate history of genocide against their own indigenous peoples no doubt came in handy in the scorched-earth warfare against the Philippine rebels, under Oakland’s General Arthur MacArthur (Douglas’ father) (Agoncillo 1969). The bloodletting took the gloss off of the imperial adventure, however; Americans, then as now have little stomach for prolonged fighting.

When Commodore Perry sailed back to San Francisco in 1853 from prising open Japan to American influence, much was made of the Japanese connection to California. But as Japan appeared increasingly as a competitor and military threat, California’s ardor turned to antipathy. Japan’s victory over Russia in 1905 (with the help of another SF-built ship!) triggered a hysterical reaction from Michael De Young’s Chronicle and Hearst’s Examiner, spawning a fearsome Anglo attack on the “yellow peril” (Becker 1991). Japanese immigration and success in truck-farming led whites to try to outlaw immigration, integrated schooling and ‘foreign’ land ownership, sparking an international furor that Roosevelt had to scramble to contain with the ‘Gentlemen’s Agreement’ of 1907 (Daniels 1977; Brechin 1995). California was again in the vanguard of anti-immigration forces in the United States (Chan 1991). It didn’t help: Japanese farmers transferred ownership to their children and Japan was running a trade surplus with the western states by the late 1920s (Willis 1937, pp 233-34). Rivalry with Japan is another unresolved element of US economic history.

San Francisco’s burgers were also casting covetous eyes on Mexico, as they had a half century earlier. The Hearsts, the Chandlers of LA, and other California capitalists were major investors during the Porfiriato of the late 19th and early 20th centuries, and billions flowed into railroads, ranches and mines. This led to mass displacements of peasants and a sharp sense of reconquista in Mexico that helped trigger the Revolution of 1910. Hearst once more turned up the volume on his media empire in a vain effort to have the United States take control of Mexico, and General Pershing was sent in to punish Pancho Villa in 1916; but full-scale war and conquest was not on the national agenda, momentarily absorbed by the European conflagration. Another imperial avenue was blocked, and many investments abandoned or nationalized before the Revolution ran its course (Brechin 1995; Acuña 1988).

In fact, San Francisco’s reach was exceeding its grasp. To make matters worse, it was destroyed by the earthquake and fire of 1906. The City rebuilt furiously in hopes of recovering lost business and a tarnished image, but was bound to suffer in any case from the ‘inconstant geography of capitalism’, in which no place in the urban hierarchy is ever secure (Storper & Walker 1989). The greatest threat to San Francisco’s hegemony lay nearest to its doorstep. By 1900 San Francisco faced increasingly sharp competition from upstart cities such as Seattle, Denver and Portland, promoted by their own burghers and boosters and aided by outside investors, such as James Hill’s Northern Pacific, Frederick Weyerhauser’s lumber empire, and the Big Four meatpackers of Chicago. Foreign trade from the northwest ports (serving the Midwest) rivaled that from San Francisco by 1920. Locally, the city was fast losing industry and residents to Oakland and the East Bay, the new ‘edge city’ and bitter rival. (29)

Los Angeles, leading city of the Mexican era, was awakening from its long sleep. The arrival of the Santa Fe railroad from Chicago triggered the land rush of the 1880s — while the Bay Area waited another twenty years for a second rail link. Southern California growers (backed by the LA business elite) took the lead in intensive agriculture with its well-orchestrated citrus exports. The main springboard to LA’s ascendance was its ‘black gold rush’ based on oil, discovered near downtown in 1892. Over the first thirty years of the 20th century, California became the leading oil-producing state in the US. (30) Unfortunately for San Francisco, the major fields were all in Southern California (despite early drilling efforts in Humboldt and Santa Cruz counties). Movies, garments, vehicles, machining, food processing, aircraft and construction all grew rapidly in the southland (Fogelson 1967). Los Angeles leapfrogged over the Bay Area to become the largest metropolis in the west by 1910.

The most potent symbol of the desire for global reach was the Panama Canal, begun at the turn of the century and celebrated with the Panama-Pacific Exhibition of 1915. Twin world’s fair in San Francisco and San Diego were linked up by the longest highway project of the day, El Camino Real, running the length of California. Panama’s narrows had first come under San Francisco’s suzereignty with the mass crossings of the Gold Rush (Pacific Mail won the franchise from the US and built a railroad across the isthmus in 1855). Dollar Steamship lines used the Canal’s opening to go global, and enthusiams were high for the city’s ability to gain additional traffic for its port, long supreme on the coast. Yet LA benefitted more from the Canal than did San Francisco, its newly-completed port being a day’s voyage closer. San Diego, meanwhile, ran a well-orchestrated campaign to gain the upper hand in military largess, becoming the homeport for the Navy’s new Pacific Fleet in 1918 (Lotchin 1992). San Francisco’s primacy in shipping and naval installations was blindsided by its coastal rivals.

Ironically, San Francisco capitalists were busily investing in rival places as a capital surplus built up in northern California (cf. Harvey 1985). In the process, they made money and helped build up the Pacific Coast, but undermined the supremacy of San Francisco. The city’s bank lending around the west grew ten-fold from the end of the depression of the 1890s to the First World War, and was the most regionally focussed of all the major US banking centers — of which it was fifth largest in 1914 (Willis 1937, pp. 22, 57). (31) Offspring of robber barons found their own golden acres to plow: Henry Huntington built the Pacific Electric system that integrated sprawling LA; John Spreckels revived a moribund San Diego; Hearst added the LA Examiner to his media empire along with a movie studio (Issel & Cherny 1986). In the 1910s, fast-rising Bank of Italy began to open branches in LA; by the 1920s, the financial giant of the west was a major player there, helping the movie and garment industries expand (Nash 1992). (32) Nonetheless, San Francisco capitalists were unable to secure a dominant place in oil, aircraft or films, the pillars of Southern California’s economy (Perlo 1957, p. 231).

San Francisco’s relation to New York has similarly been one of intense ambivalence, pulled between autonomous accumulation and subservience to the nation’s economic capital. Many Gold Rush merchants such as Levi Straus came with money and connections made in New York (Senkewicz 1985). Wells Fargo started in 1852 as a spinoff of American Express, keeping close relations to the end of the century (Doti & Schweikart 1991). Later, many successful San Francisco capitalists of the Gilded Age, such as Darius Mills, Collis Huntington and Horace Carpentier, took their loot and moved to Fifth Avenue, investing fortunes back east. Huntington built the shipworks at Newport News. Francis Newlands, son-in-law of Sharon, built Chevy Chase outside Washington, D.C. Young Hearst took the greatest fortune of the age and plunged it into New York publishing (Swanberg 1961; Brechin 1995). (33)

America’s rise to global economic primacy meant national subordination to New York and decoupling from London (Reed 1981). New York was exporting capital nationally and globally, as San Francisco was doing regionally, and Wall Street was buying up everything in sight. The great investment banks, led by JP Morgan, were rearranging the business landscape by engineering the consolidation of the Trusts and serving as midwives for the new breed of corporations created by Rockefeller, Sloan and Dupont (Lamoureux 1985). At the same time, Carnegie, Taylor and Ford in the east and midwest were introducing revolutionary new ways of making steel, cars and other heavy goods. California soon felt the heat of these production changes, and San Francisco had its pretensions further nipped; but it never suffered eclipse in the fashion of other regional centers such as Baltimore and Buffalo (e.g., Perry 1985). (34)

The Southern Pacific was, symbolically, the most shocking loss, passing to control of New York financier Edward Harriman in 1901 at Huntington’s death. Rockefeller’s Standard Oil bought up Pacific Coast Oil in 1900. AT&T bought Home Telephone, Pacific Telephone and Western Electric. Pacific Gas & Electric became almost wholly owned by eastern financiers (Perlo 1957). Pacific Coast Steamship was sold to the east coast Villard syndicate. In the 1910s and 20s, Ford and General Motors quickly moved west, building assembly plants or buying up rivals. Later, Bethlehem bought Union Iron Works and US Steel grabbed Columbia Steel. Dupont bought out California Powder. American Smelting and Refining (Guggenheim) bought up Selby Lead. Swift & Co. moved into South SF, pushing aside local butchers.

Nonetheless, external ownership was never more than perhaps one-quarter of industrial holdings in California, and branch plants were not the basis of California’s manufacturing growth (Trice 1955). Many companies nominally controlled from the east, such as Southern Pacific, Pacific Bell and PG&E, kept their headquarters, purchasing and decision-making in San Francisco. So simple ownership says little about the fate of the region without a detailed knowledge of business organization, investment patterns, employment, markets and innovation. (35) The argument can just as well be made that outside capital was buying into California’s strengths. Outside acquisition and financial control was a rolling process from 1900 to the 1930s that must be measured against the upwelling of industry during this epoch. Agro-processing, petroleum, electricity, telephonics and motors vehicles were industries just hitting stride, and electronics was entirely new. (36) Illustrative cases follow.

The water resources of the Sierra and Northern California, harnessed by the modern turbine (based on Pelton’s water wheel, invented for mining in California), allowed the rapid development of hydroelectricity around the turn of the last century. San Francisco capitalists organized power and lighting companies throughout the region (Issel & Cherny, p. 47). The greatest hydraulic system on earth was in place by 1920, producing abundant electricity for the region as well as irrigating millions of acres for agriculture (Pisani 1984). The consolidation of several electric companies under the head of Pacific Gas and Electric made it the largest public utility in the US (which it remains today). The need for big capital brought it under the financial suzereignty of New York in the 1920s, but PG&E remained quite independent. (37)

By the turn of the century, California led the world in agro-processing, organization and marketing. Its canners introduced the first name-brand foods (Del Monte was registered in Britain in 1896) and mass advertising, including the first industrial film in 1917. They moved from there to setting up the world’s most advanced system of contracting, both backward to the farm and forward to the new supermarket chains (A&P, Safeway, etc)(Cardellino 1982; Braznell 1982). As a result, the local canning industry won out over rivals in the Midwest for both national and international markets. Two waves of merger (1899 and 1916) culminated in SF-based California Packing Corporation (CalPak, later Del Monte), controlling 50% of the state’s canneries — with the financial backing of Bank of California and Solomon Bros of New York (and Balfour, Guthrie were there as major owners of Alaska Packers). Chicago’s Libby, McNeil and Libby shifted west in 1909 to join in the action, as did Pittsburgh-based Heinz, while CalPak invaded their territory and went abroad to Hawaii and the Philippines. Hunt Brothers (1896) remained independent until bought much later by LA’s Norton Simon. Food processing was the Bay Area’s largest employer as late as 1940 (Calkins & Hoadley 1941).

California agribusiness continued its conquest of national fresh fruit and vegetable markets (and grabbed cotton from the South in the 1920s and 30s) (Liebman 1983). When the Armenians fled Turkey for Fresno, California became the western hemisphere’s supplier of raisins. DiGorgio Fruit was formed into one of the world’s largest producers and marketers of fresh fruit in 1920 (from Joseph DiGorgio’s forty-some companies), with holdings all over the west as well as control over the Baltimore and New York fruit exchanges (Issel & Cherny, p. 45). And there were supplier spinoffs as well. The caterpillar tractor was invented in 1904 by Stockton’s Benjamin Holt, an agricultural equipment maker, who built a factory in Peoria in 1909 (later moving the Caterpillar headquarters there). After being dependent on New England machinery companies in the 19th century, California canners came to rely on a stream of innovative pitters, peelers, steamers and the like from local firms such as Anderson-Barngrover and Food Machinery Corporation (FMC) of San Jose (Cardellino 1982). (38)

California’s oil industry was essentially a local enterprise during its heyday, and did not become fully integrated into national markets (let alone global ones) until the 1960s (Johnson 1970; Andreano 1970). Little California oil made it out of state, but it did go by pipeline, ship and tank-car to the Bay Area, which became one of the half-dozen major refining centers in the country (SoCal, Union, Associated-Tidewater, Shell, Exxon, etc.). California industry and transport companies quickly learned to to use fuel oil instead of scarce coal, setting an example for the world. (39) California also put its asphaltic crude to good use paving the largest highway system in the world and its natural gas for heating the cities.

California petroleum was very widely owned in this period. Pacific Coast Oil missed the boat, (40) but Standard Oil never controlled the action as it had in the east, and after its breakup in 1911, SoCal (now Chevron) was headquartered in San Francisco (and local management was delighted with the autonomy) (White 1962). (41) Associated Oil was formed by dozens of Kern River investors in 1901 to market their product, and the Independent Oil Producers Agency followed the example in 1904. Associated came under stock control of Southern Pacific in 1910 to feed its voracious appetite for fuel oil. That year, San Francisco capitalists John Barneson and Joseph Grant created General Petroleum and the Crockers started Universal Oil Company, the next biggest players in the state. (42) Anglo-Dutch Shell entered the regional market by buying a major California oilfield in 1913 from the Scots at Balfour, Guthrie and put its divisional headquarters in San Francisco (White 1962, p 224). Union oil, a Southern California company, remained independent, despite efforts by the British to obtain it. (43) True, San Francisco’s role diminished as bigger oil fields were discovered and more refineries built in the LA basin, and California’s oil industry fell to the majors in the late 1920s and 30s, as Mobil and Exxon bought out General and Universal Petroleum and Associated merged with Tidewater; but external came late in the day and did not adversely affect the regional oil boom.

And, here again, technology rather than commodity flows, was the state’s main contribution to global industrialization. While California’s oilfields were originally developed by the oilmen of Pennsylvania (which played a seedbed role comparable to California in mining), the state eventually created its own pool of expertise through practical encounters with complex geology, university training (at Berkeley and Stanford), and investment in research (Union Oil, SP); this it exported. Several oilfield production techniques such as core sampling, deep drilling, cement-casing, offshore drilling, and secondary recovery through injection were developed here; Eric Starke’s kerosene cleansing method of 1896 lit the lamps of China; pipeline systems were improved; California led the way in high octane gasoline; and Jesse and CP Dubbs’ Universal Oil Products Company (backed by SoCal and Shell) was a major contributor to the development of continuous flow refining and catalytic cracking in the 1920s and 40s (Taylor & Welty 1950; White 1962 1970; Enos 1962).

The conventional history of Silicon Valley usually begins with William Shockley and the transistor in the 1950s, but a substantial electronics industry had already set up shop in the Bay Area in the early 1900s (Sturgeon 1992). It was here (mostly south of San Francisco, on the Peninsula) where Lee DeForest invented the vacuum tube, the key to electronic devices before solid state; where the first ship-to-shore radio transmission took place and the first radio station was established; where the loudspeaker and the television were invented; and where tubes were first mass-produced. World War I Navy contracts gave the locals a boost, but they were still far behind the behemoths of the east coast in output of standard devices like radios and turbines in these years. On a related front, Marchant Calculating Co. (later joined to Smith Corona) produced a high quality adding machine in Emeryville and sold it overseas by 1920.

While never out of the financial shadow of New York, San Francisco held onto its position as an independent pole of accumulation that Wall Street could never bring to heel. Indeed, San Francisco and New York financiers were able to work hand-in-hand in most cases, more so than the conflictive relations of competing Eastern financial centers (Perlo 1957). While San Francisco was poorly endowed with investment banks, it could produce Charles Blythe, whose Blythe and Company, acquired by First National City Bank, went on to underwrite twice as many securities for the Pacific states as all other Far West houses combined (Perlo 1957, p 229). (44) New York bankers led the drive for the Federal Reserve System in 1908, but it only confirmed San Francisco’s financial hegemony over the west by the selection of the City as the Federal Reserve district headquarters and clearinghouse (Willis 1937). (45)

The rise of AP Giannini and his Bank of Italy (founded 1904) is the clearest example of New York’s inability to control all upwellings of capital in the highly regionalized US economy and banking system. Bank of America (it took the name in 1929) grew along with the region, gathering in the savings of the state of California and lending them out to businesses and consumers to grease the wheels of development (Nash 1992). Giannini’s empire rested on aggressive use of branch banking (long held suspect in US politics); willingness to risk lending to small borrowers (for small business, farms and homes) and large companies with big ideas (Walt Disney, Henry Kaiser); and the luck of being in California. Bank of America’s run to the top and San Francisco’s leap to second banking city in the United States by mid-century is comparable to the way so many obscure banks of Japan now rank among the world’s largest: they all rose with the climb of the underlying economy (cf. Reed 1981, pp. 55-58). (46)

Thus, while San Francisco’s pretensions to imperial power were curbed by national and international rivals, it found new sources of strength in the regional economy that would ultimately catapult it to new global importance. In this it was aided by natural wealth, in-migration, skilled labor and deep pools of capital, as well as by a still formidable position in a western region that was growing faster than ever. (47) Thus, San Francisco remained more dominatrix than love-slave to the whipsawing of competitive fortune and the inconstant affection of capital for places.

Regional Powerhouse in an Age of War

The global calamity of the Second World War pushed California once again to the front of the world’s stage (Nash 1985). The crucial geographic fact was the global shift marked by the war in the Pacific. The opening of Japan proved quite the Pandora’s box, finally bringing imperial rivals into murderous conflict (not by accident did the Japanese attack Hawaii, either). The West Coast was the staging area for the Pacific theater, with the Bay Area as its pivot. Like another gold rush, the war brought 10% of Federal wartime expenditure to the state, including an amazing 38.5% of all continental US military construction on over a 100 military installations (Brubaker 1955), and channeled millions of people into California bases, embarcation points and war industries, many of whom came back to stay (Johnson 1993). (48) Conversely, it led to the dispersal of Japanese-Americans, who were ignominiously shunted into concentration camps all over the western US (Daniels 1977).

California was more than ready to seize the new opportunities of wartime. Federal spending did not flow to open hands and an empty land, making an economic desert bloom. California had reached a high level of industrialization, and its leading sectors would have attracted millions in Army and Navy contracts regardless of the transects of global warfare and Federal spending (Scott 1994). Moreover, California capitalists and politicians had learned very well the art of milking the Feds for government aid and contracts (e.g., the port of Los Angeles and the Naval base in San Diego) (Lotchin 1992). (49)The key beneficiaries were aircraft and movies in the southland and electronics and construction in the north, but oil companies, garment makers, agribusiness, steel mills, vehicle assemblers and machine shops up and down the state did well off the war, too. And banks were put on a sound footing after a decade of depression.

Construction is probably the least appreciated and studied of industries, yet its works are with us everywhere. California companies pioneered in large-scale constructions, from pipelines and bridges to highways and housing tracts, in the period between the two World Wars. No doubt the ferocious rate of development in areas such as oil, water resources and suburbanization had much to do with the innovative stance of local firms, but so did a tradition of engineering achievement and a certain bravado that made doing the impossible an accepted challenge. And it stimulated various supply industries, such as structural steel (provided by the likes of Judson-Pacific), asphalt, cement, lumber and plumbing fixtures.

California nurtured several brilliant firms in civil engineering, industrial engineering and housing construction, but the Bay Area’s Henry Kaiser and Stephen Bechtel stand out.(50) They began by laying railroad tracks, but soon moved into road-building, a California growth sector after the first state gas tax in 1917. Kaiser was the first to get rid of horses and mules in favor of earth-moving machinery on roads and dams in the 1920s, absorbing a heavy-equipment manufacturer to meet his own specs; he also introduced deisel engines into all construction equipment (Kaiser 1968). Kaiser’s first really big project, however, was international — 200 miles of highway in Cuba, completed in 1930.

Waterworks had been a California specialty from the time of the hydraulic miners, and engineers such as von Schussler and Mulholland had built dams, canals and aqueducts far larger than anything since the Romans (Brechin 1993). So it is not surprising that Kaiser, Bechtel and a consortium of eight firms (51) built the world’s first high-arch concrete dam (an exceptional technology at the time) at Boulder Canyon on the Colorado River, and the global age of high dams was born (Hundley 1992; Foster 1989). Various of the Six Companies went on to build Bonneville and Grand Coulee on the Columbia, and Kaiser and Bechtel built the Golden Gate and Bay Bridges. They tackled everything from tunnels to drydocks in those years, and grabbed contracts from New York to Panama to Hawaii (Kaiser 1968).

During the War, the builders turned their attention to merchant ships, converting the San Francisco Bay into the biggest shipyard the world has ever seen (some 200,000 workers in the Bay Area alone, plus another 150,000 under their dominion at yards in Los Angeles and Portland). Knowing little of the arts of the industry before starting, they put into effect revolutionary mass-production systems of the Fordist type so as to be able to produce ships in record time (Wollenberg 1990). During the War, Kaiser became one of the biggest industrial employers anywhere. Along with his shipyards and dams, Henry took the opportunity presented by government investment in steel and aluminum plants on the West Coast, federal animosity to the monopoly position of Alcoa and US Steel, and good connections to the Democratic administration (which he had supported when few big capitalists would) to buy up the Fontana Steel Works east of LA and aluminum plants in Washington (powered by cheap electricity from the new dams). He added cement, gypsum and chemicals to feed his construction works, and built housing tracts as he had built the company town of Boulder City.

World War II brought a new generation of West Coast wizz-kids out of into the limelight of electronics Hewlett-Packard and Varian became major players overnight thanks to their advanced technology in tubes for radar and sonar. Eitel-McCulloch prospered, as well. By the Korean war, Lockheed (which had started in the Bay Area before jumping to LA) moved its enormous aircraft and missile electronics operations back to the South Bay. Philco(-Ford) moved nearby and NASA put its missile tracking station at Moffitt field, while Ampex used German tape recording technology to good effect in becoming the leading producer of tape recorders in their early years. Long before silicon chips, the Bay Area was a leading region for innovative electronics, as well as a partner in crime with Southern California in the creation of the military-industrial complex the ruled the Cold War globe.

California’s oil industry continued to have a global impact, in new ways. First, Californians invented and promoted unified operation of oilfields, and the US adopted prorationing after a long campaign in the 1920s led by the American Petroleum Institute, which was dominated by Californians such as Mark Requa.(52) Production and import controls supported US and global oil prices for decades. Second, Californians developed oilfields around the world. Petroleum engineer Ralph Arnold became a prominent international consultant, for example. By the end of World War I, almost all the American oil companies were looking abroad, and in 1920 California Senator James Phelan tried to establish a US government corporation for overseas exploration. Most significantly, Standard of California opened up the Bahrein and Arabian oil reservoirs in the 1930s, revolutionizing the geography of global oil and politics for the rest of the century (Blair 1976, pp. 35-37). Lacking distributors in the eastern hemisphere, SoCal joined with Texas Oil (Texaco) to form Cal-Tex and then Aramco to exploit the enormous Saudi fields. During the Second World War, SoCal and Texaco cut Jersey Standard (Exxon) and Socony (Mobil) into the Aramco deal, keeping world production and prices under control but losing the opportunity to vault over their rivals into first place among the ‘Seven Sisters’. (53)

Bank of America grew fat along with the industrialists and agriculturalists of the region, and the Second World War gave it the final lift to the pinnacle of the banking world. Giannini lent to Kaiser and the big builders, the burgeoning homebuilding industry, Goldwyn and movie moguls, and agribusiness right through the Depression — often when no other lenders could be found, as for the Golden Gate and Bay Bridge bonds (James & James 1954, pp. 399-411). Only oil was too wild for AP’s enthusiasms. He also had national and global ambitions. He very early started branch systems in other western states and bought a bank in New York and one in Italy in the 1920s. US banking laws, backed by Wall Street as well as small banks of the farm states, held at bay his efforts to create the first interstate banking chain, Western Bankcorporation (something only now being done). Giannini fought tooth and nail with the New York bankers, particularly the House of Morgan, as his bank grew large enough to challenge for national supremacy and a piece of the international action. Morgan’s men actually seized Giannini’s holding company in the mid-1930s, forcing him off the board of directors; but Giannini undertook a whistle stop tour of California to woo his many small stockholders, winning back control a year later. Giannini also quarreled endlessly with the Federal Reserve and bank regulators in Washington, and this ultimately cost the antitrust action that split Bank of America from Transamerica (and Western Bankcorp) in the 1950s (Nash 1992). (54)

Postwar Globalism

As the United States took charge of the world capitalist system in the second half of the 20th century, San Francisco was well positioned to reassert itself in the global economy. The United Nations Charter was signed here — although the dream of keeping the headquarters of the UN in the city was squelched by the Atlantic Alliance. Nevertheless, the postwar era was a time of great prosperity for the Bay Area. Incomes rose to the top of all major metropolitan areas in the country, except Washington, D.C.. The regional economy grew rapidly, powered above all by the electronics industry, and would rank around 15th in national output if this were a country. Population ballooned to six million by the mid-1980s, pushing past Philadelphia and Detroit to 4th place among US cities.

California agribusiness began a new wave of globalization after the war. Del Monte was the world’s largest agro-processing firm and Safeway (in Oakland) the world’s fastest-growing supermarket chain, and the largest during the 1970s and 80s. (55) Del Monte set up its first canneries outside the Pacific basin in the 1950s, in South Africa and Italy, expanding into Britain, Kenya, Venezuela and Mexico in the next decade (Braznell 1982; Burbach and Flynn 1980, pp. 164-219). Safeway went to Europe and Latin America, while JG Boswell was growing cotton in Australia (Liebman 1983). California growers pushed further into Mexico (Lizárraga 1993). More generally, the California agro-production system set the pattern for industrialized agriculture around the world (outside of grains) (Perelman 1977). California growers demanded an exceptional level of industrial inputs and infrastructure. Irrigation was doubled and redoubled by the Colorado River and Central Valley Projects built in the 1930s and 40s (Hundley 1992; Worster 1985). California growers drove the most advanced machinery over the world’s largest farms, and had some of the most advanced plant breeding laboratories at their service, thanks to the University of California. The modern feedlot system for fattening cattle was begun in the state (Page 1993).

By the end of the war, Bank of America was moving aggressively into Asia and Europe, becoming the first international bank outside of New York. San Francisco joined the second tier of global financial centers by the 1950s (on a par with Osaka, Hong Kong, Bombay or Amsterdam) — even though its other big banks, Wells Fargo and Crocker-Anglo, had almost no overseas presence (Reed 1981). Business at home was booming, after all, with four California banks reaching the top dozen in the country. (56) Bank of America introduced the first universal credit card in 1959, and it soon swept the nation as the Visa system. Another group of California banks, led by Wells and Crocker, followed with the Master Charge (Mastercard), which became the second standard in consumer credit (Doti & Schweikart 1991, p 196). (57) Bank of America’s overall business abroad remained modest until the 1970s when it joined in the general global euphoria, setting up overseas offices, buying foreign banks, and joining the Eurodollar market in London — quadrupling in size and garnering 40% of its profits abroad. B of A syndicated loans from Brazil to Indonesia — laying the basis for the debt debacle of the 1980s. CEO Tom Clausen — a dry Midwesterner — was rewarded for his profligacy with the presidency of the World Bank in 1981 (Hector 1988; Johnston 1990).

In the 1950s and 60s, Kaiser and Bechtel led the rebirth of an international construction industry, building dams, refineries, pipelines and other infrastructure along lines laid down in California. Kaiser Engineers built a dam in Australia in 1954, then a steel mill in India, and was in dozens of countries by the 1960s. Kaiser made the mistake, however, of subordinating construction to his ambition to become the Henry Ford of the West; he took an ill-fated turn to steel, cars and household appliances in the late 1940s, and lost his shirt (Foster 1989; Davis 1990). Defeated by the Big 3 car-makers in the US (his economy sedan arrived a decade before the Volkswagen bug), Kaiser put the first auto plants in Brazil and Argentina in the mid-50s (Kaiser 1968). Still ranked 25th in the Fortune 500 in 1967, the Kaiser empire unwound gradually after Henry died that year, and fell apart completely in the 1980s. Kaiser should have stayed with his California strengths, but fell an early victim to the delusions of Fordism.

Bechtel stuck with construction, becoming the world’s largest such firm in the 1970s (Strassman & Wells, 1982). Bechtel rode the wave of petrodollars that turned the Middle East into the world’s hottest construction zone, and became one of a handful of truly global engineering and buinding contractors. San Francisco’s Guy Atkinson, builder of Venezuela’s Guri Dam, and LA’s Parsons and Fluor were also among this elite. Bechtel was the only construction company to have its own research department working on advanced design for factories, fiber-optics and the like. It sent two of its directors, George Schultz and Caspar Weinberger, to the most powerful positions in the Reagan cabinet, better to oversee the global dominions of the American empire. But Bechtel also stumbled over the oil bust of 1979-82.

The role of microelectronics in the recent growth of the Bay Area and California is by now well-known (Saxenian 1983, 1994). Silicon Valley seized hold of global leadership in the technology of microcircuitry on a chip in the 1950s and 60s, becoming one of the world’s premier industrial districts in the process (Ernst 1983). Semiconductor firms begat new semiconductor firms in a seemingly endless round of spinoffs during the 60s and 70s. Mainframe and mid-sized computers, and their key parts became specialties of the Valley, along with medical and scientific instruments and aerospace guidance systems. The leading companies of the Valley, such as Fairchild, Intel, National, Amdahl and Hewlett-Packard, clambered into the Fortune top 100. These, in turn, set up global operations, from assembly houses in Southeast Asia to computer and components plants in Silicon Glen, Scotland — pioneering the new global division of labor in the process (Flamm 1984). Established giants, particularly Lockheed and IBM, ran gigantic components factories here. Jobs were plentiful, both for high level engineers and low level assemblers. Globalization is a wonderful thing when you have what it takes to make what everyone else wants.

Federal expenditures in the Cold War era were beneficial to the Bay Area, even though it did not wax as fat as Southern California did on defense contracts. The Federal deficit in California ballooned from $225 million in 1952 to $2.5 billion in 1960; notably, as much was paid out in wages to federal employees and transfer payments as was spent on military contracts (Minsky 1965, pp 117-18). The Bay Area was also pivotal in the Faustian pact with atomic energy, and E.O. Lawrence was the uncrowned emperor of Big Physics, leveraging millions of dollars out of local capitalists, the state of California, and the US government to build his cyclotrons, and the driving force behind the Manhattan Project (Heilbron & Seidel 1989). After his death, the Lawrence labs continued to force-feed the engines of darkness, including Neutron bombs and Star Wars. University of California scientists and Pacific Gas and Electric Company also pioneered the so-called ‘peaceful atom’ campaign. But nuclear technology, while changing the world, did not benefit the region’s economy in the same way as electronics — the labs and star wars and aerospace electronics paid off, but the peaceful atom was a bust and only one nuclear power plant was ever built in California.

Global Opportunities, Global Hazards

By the 1970s, the US was opening up to global trade, inward investment, and international migration to an unprecedented degree, with California leading the country in all regards (Ettlinger 1991; Erickson & Hayward 1991). California was home to over half the $70 billion in foreign-owned assets in the US by 1989. Yet global competition and long-wave doldrums hit the Bay Area as they did the rest of the country. And while the region showed resiliancy in the face of economic change, it took several body blows and suffered the same depressing characteristics of human sacrifice under neo-liberalism as the rest of the world (Walker 1995).

Silicon Valley passed up San Francisco and the East Bay as an employment center in the 1970s. The reality of this shift was brought home starkly by the1982-83 recession, which clobbered heavy industry in the East Bay — a microcosm of the industrial-spatial revolution hitting the US (Shapira 1984; Storper & Walker 1989). At the same time, the new Edge City of the outer East Bay added 20 million square feet of office space during the 1980s; many San Francisco companies have relocated major operations there, including divisional headquarters and high-level functions (not just back office clerical work, as was the case earlier in the process of decentralization). All this undermined San Francisco’s long claim to hegemony in the region (Walker et al. 1990). Yet a continuing investment boom — particularly in commercial development — carried the regional economy through the early 80s with less pain than expected before the crunch finally came in both finance and electronics. Overheated speculation left a rash of bankruptcies, bad loans and unleased buildings. Silicon Valley and San Francisco recovered in the latter 80s, but not without shedding tens of thousands of jobs.

By the late 1970s, international competition in microelectronics had stiffened and Silicon Valley could no longer claim the quasi-monopoly it had once enjoyed. The Asians and Europeans were racing to catch up with US leadership, while Boston’s Route 128 was booming from its dominance in mid-sized computers. Japanese electronic companies, in particular, had a mastery of mass production that had swept aside American producers of consumer electronic goods like televisions and seemed poised to do the same in standardized semiconductors. Suddenly, Japanese firms were crowding formerly unassailable US firms from the top ten semiconductor firms in sales and profits. Doomsayers predicted the end of Silicon Valley, and seemed to be vindicated as the rampant investment bubble of the late 1970s and early 80s turned to ashes in 1984-86, leaving a wake of unfilled, speculatively built industrial space covered with “For Lease” signs (Kroll & Kimball 1986).

But the Valley was retrenching, as standardized semiconductors were shed as unprofitable and replaced by personal computers and speciality chips for such pre-programmed duty as running automobile ignition systems. New generations of small computers soon followed hard on one another, putting Apple’s MacIntosh and Sun workstations at the top of the charts by the end of the 1980s. Intel kept ahead of the baying pack by packing more and more circuitry on its central processing chips. Smaller and more powerful disk drives and other peripherals were another strength. Silicon Valley ended up back on top of the global heap (Saxenian 1994). A new recession in the early 1990s cost many more people their jobs, but the Valley successfully reconstructed itself again. Now RISC chips are driving computers, PCs and workstations are converging, and software is now the employment growth leading in the industry. Artificial intelligence, special effects, virtual reality and other fantastic concoctions of the new machinery and software are all arenas in which Silicon Valley still leads the competitive race (Egan 1995; Skinner 1993). Unable to maintain the same pace of innovation, the Boston electronics complex shrank (Saxenian 1994), while companies from all around the world — including Japan — have branches in the Valley in order to keep abreast of new technology. Silicon Valley remains the engine of growth for the Bay Area, with the highest concentration of manufacturing of any locale in the US. The Valley has surpassed San Francisco and Oakland in number of Fortune 500 companies, and Intel and Hewlett-Packard now exceed Bank of America and Chevron in market value, after the recent run-up in high-tech stocks.

In San Francisco, the story turns on Bank of America, which nearly collapsed in 1985-86. When the crunch finally came, the bank was badly overcommitted in oil, agriculture and real estate in the United States and the Third World. It began furiously shedding pieces of the empire, writing off bad loans and searching for white knight investors (Johnston 1990). Japanese investors’ willingness to buy the Bank’s downtown office building in Los Angeles and to inject $700 million in capital helped save the day — a graphic illustration of how the flood of Japanese money into the US during the 1980s saved the day for the American economy and global stability (quite the opposite of Mike Davis’ (1990) implication that Japanese buyouts are a dead loss to California’s independence) . Bank of America was not alone, of course, as Crocker bank failed because of real estate speculation in the 1970s and many Northern Califonia S&Ls were among the worst offenders in the debacle of the 1980s (Pizzo et al. 1989). Charles Knapp’s Financial Corporation of America (out of LA) used Northern California’s American Savings & Loan to become the biggest S&L for a time before flaming out, while Larry Hagedorn took SF’s First Nationwide Financial Corp. to the second spot among S&Ls before selling out to Ford Motors (Robinson 1990). (58)

The recession of the mid-80s in the Bay Area made San Francisco’s economic fortunes look like dying embers compared to the raging fires of LA during the Reagan years. But the latter was based on militarism, money and Mexicans, i.e., a debt-financed weapons buildup rapidly exhausting the national treasury, cheap money generated by junk bonds and bilious Savings and Loans, and cheap labor flooding across the border (Walker 1995). LA may be the ‘capital of the 20th century’ but it was also a fool’s paradise (cf. Scott and Soja 1986; Soja 1991; Scott 1993). The result was the worst depression in California since the 1930s, centered in the South. The North got through the early 1990s with less pain than LA. (59)

Predictions of LA as the new financial capital of the West Coast (60) were belied by Bank of America’s amazing turnabout: having almost been sold to one LA bank (First Interstate), (61) B of A recovered to buy LA’s biggest bank (Security Pacific) in 1990 — catapulting it back into the number two spot among US banks. Futhermore, Bank of America recast its geographic strategy back from freewheeling globalization to a stronger presence in the western US. The banks that have grown most dramatically over the last decade, e.g., BankOne of Ohio and North Carolina National Bank, are those expanding regionally rather than those that went national too fast, e.g., First Interstate, First Nationwide, and Citicorp. B of A has now invaded the Midwest, buying up Continental Bank of Chicago.

This does not mean the Bank of America has abandoned the international field. It still clears billions per year in currency transactions. San Francisco remains a premier banking center, attracting scores of branches and agencies from banks around the world. (62) The Visa credit system is coordinated from Foster City, near the SF airport. Charles Schwab invented discount brokerage in the 1970s and is now one of the major dealers outside Wall Street. The region’s financial complex includes the largest pool of venture capital in the world, centered near Stanford (Florida and Kenney 1988; Florida and Smith 1993). This was a spinoff of electronics, and attracts billions of dollars of high-return funds from New York, Chicago and around the globe to invest in start-up companies in electronics, biotech, software, and retail in the Bay Area. Venture capital dried up in the early 90s, but has rebounded smartly of late.

Meanwhile, the core of the region has witnessed the loss of many old-line companies — some eighteen of the thirty-two Fortune 500 industrial companies headquartered in SF and Oakland in 1979 (McLaughlin 1988). Some faded away during the postwar boom, such as Blake, Moffitt & Towne, City of Paris and Lucky Lager. Many more were gobbled up in the mergers of the 80s, such as Crown-Zellerbach, Genstar, Pacific Lumber, and Natomas. Even relatively new companies, such as Intel, Shaklee and Cost Plus, succumbed. By 1988 the Japanese held five of the eleven largest California banks, including SF-based Bank of California (Mitsubishi) and Union-Cal First Bank (Bank of Tokyo) — now slated for merger along with their parents. In the mid-90s another wave of mergers and bankruptcies swept away Emporium, I. Magnin, SF Federal Savings and Southern Pacific. (63)

But the effects of corporate change can be exaggerated. Hundreds of Bay Area companies are involved in mergers each year, in good times and bad, and an acquired company and its local office functions may not disappear (e.g., Macy’s West), some reemerge as independents (e.g., Del Monte), and some are bought back (e.g., Wells Fargo taking Crocker from Barclay’s Bank). Some supposedly local companies are already foreign-owned (Bank of California was bought from the Rothschilds, Golden State Sanwa bought up Lloyd’s Bank of California). And outside purchase can mean substantial new injections of capital, as with Japanese rehabilitation of the Palace Hotel, while the most draconian cutbacks in employment are overseen by local companies, as in the elimination of branches and relocation of back offices by Wells and B of A. Whatever the effects of mergers and acquisitions, most of them are home-grown in the US, where merger mania has been a leading response to changing economic circumstances, and is linked only indirectly to globalization (cf. Lewis 1989).

Moreover, it is disingenuous to cry wolf about ‘outside control’ when San Francisco has been the spider in a web of distant exploitation for its entire history. San Francisco capitalists have investments nationwide and worldwide, from which they, too, siphon off profits (Pred 1977). The sword of acquisition continues to cut both ways: Chevron bought Gulf Oil (1979), Bank of America has been buying banks all over the west, and California First Bank bought L.A.’s Union Bank and moved its headquarters to SF. Moreover, San Francisco companies have seized upon new global opportunities. Pacific Telephone spinoff, Cellular One, is the world’s most successful cellular phone company. Chevron has recently secured the concession for the massive Tangs oil field in Kazakhstan, the largest in Central Asia . Bechtel is building Hong Kong’s new airport and a technopolis outside Moscow. The city’s China-connection is paying off in terms of trade, banking and cross-investment with the surging South China Sea region.

Despite major real estate purchases by international investors adding up to about 30% of downtown by the mid-1980s (Asian investors have been particularly active in hotels, office buildings and commercial properties), the biggest international players in local property development, Canada’s Cadillac Fairview and Olympia and York, went bust in the last downturn and many Japanese investors were stiffed for billions in California’s real estate crunch (Tabb 1995). And if one is concerned about ‘local control’, how democratic is realty kingpin Walter Shorenstein’s ownership of 30% of downtown SF? (Delehanty 1989, p 66). Shorenstein used the recessions to good effect in buying up properties such as the Bank of America headquarters building, and more in LA and other US cities.

The most significant factor in San Francisco’s decline relative to Silicon Valley or Los Angeles is that its home companies are largely remnants of an older, regional industrial base resting on timber, paper, oil, department stores, food processing and mining, which are no longer growth sectors (cf. Malone 1986). One older sector that still thrives is clothing, with Levi Corporation the world's largest garment-maker and The Gap not far behind (and others such as Koret, Esprit and Victoria’s Secret still doing well) — although production is through global networks and local factories have been shut down (Louie 1992). Meanwhile, in the high-tech sectors the Bay Area still leads the world, and is again adding thousands of jobs in the mid-1990s. Not a bad prospect for a region struggling with global challenges. In biotech, one finds giant international pharmaceutical companies such as Bayer and Hoffman-LaRoche buying into local start-ups, leading to the erroneous impression that local initiative has been lost. In fact, the multinational drug companies are desperate to get their hands on the new technologies dreamed up by Bay Area research teams, and keen to provide much-needed infusions of capital to sustain long-term product development efforts. Bay Area biotech remains a leading node in a worldwide network of pharmaceutical production and marketing, and one which will continue to transform an entire industry (Kraus 1996).

Agribusiness remains a huge segment of the regional economy, even though the old canneries, sugar mills and baby food plants have shut down in favor of Central Valley or overseas locations, or because of slackening demand for such food products. (64) Northern California remains the world’s largest producer of fresh vegetables (not to mention strawberries, raisins and processing tomatoes), though its hegemony in fresh fruits has been broken by Florida and Texas and winter produce coming from as far away as Chile and New Zealand. (65) Partly this is the work of California companies themselves, particularly in Mexico (Lizárraga 1993). But a globalized agro-export system, more than ‘offshoring’ by US capital, has increased competition from capitals of all nationalities operating on principles developed in California: high-input, high-intensity farming organized by contract system and huge agribusiness corporations (Watts 1992). Leadership in new forms of contracting has also passed elsewhere, for example, to British supermarket chains. Nonetheless, California growers have responded by shipping oranges and rice to Japan and table grapes to Hong Kong. Growth in this labor-intensive domain has been so formidable that, despite mechanization and use of herbicides, demand for harvest labor has shot up to almost 700,000 workers, over 90% of whom are immigrants (Villarejo & Runsten 1993).

The largest employer in the city of San Francisco today is a different sort of global industry: tourism. The city was already a tourist stop of sorts in its boisterous youth,. In the last quarter of the 19th century, tourism’s principal face was turned toward the great outdoors, at the Hotel Del Monte near Carmel or Yosemite National Park (Pomeroy 1957). The great exhibitions of 1894, 1915 and 1939 were special drawing cards. Both the hotel district and Chinatown were expressly rebuilt after 1906 for the tourist trade — the latter with faux-Ming rooftops and porticos to spice it up (Groth 1994; Delahanty 1989). (66) The Barbary Coast long had an alluringly unsavory reputation (Asbury 1933), maintained in our time by Broadway topless joints, porno films, and the naughtiness of gay exhibitionism.The city’s taste of the ‘exotic east’ lives on with its fabulous throng of newly-arrived peoples from the Pacific Rim (the percentages of Asian-Americans in the Bay Area are highest of any city in the US today).

In recent times tourism has exploded as a money-making activity for the city, as in so many parts of the world (Urry 1990). The tourist ‘industry’ claims over 13 million visitors a year staying at the city’s 30,000 tourist hotel rooms and eating at its 3,500 restaurants — keeping San Francisco just ahead of Disneyland as a California tourist attraction. San Francisco was rated the number one international travel destination in 1991 and 93 by the elite Condé Nast poll. The city has kept its reputation for beauty, thanks to the Golden Gate, the Bay, and the fog, as well as the unsung efforts of preservationists to save something of the landscape. Sadly, San Francisco has also sacrificed part of itself on the alter of theme parks, as in the plasticity of Fisherman’s Wharf, and repression, as with police sweeps of the homeless.